Have you ever wondered what happens when blockchain technology meets the physical world around us? Decentralized Physical Infrastructure (DePIN) is transforming everything from wireless networks to energy grids, creating unprecedented investment opportunities while solving real-world problems. Imagine earning passive income just by sharing your internet connection or contributing to a decentralized mapping network—this isn’t science fiction, it’s happening right now.

What is Decentralized Physical Infrastructure (DePIN)?

Think of decentralized physical infrastructure as the ultimate crowd-sourced revolution. Instead of massive corporations owning and controlling all the physical networks we rely on—cell towers, Wi-Fi hotspots, weather stations—DePIN allows everyday people to own pieces of these networks and get rewarded for their contributions.

It’s like turning your home into a mini data center, weather station, or wireless hotspot, except you’re part of a global, decentralized network that any single entity can’t control. Pretty cool, right?

The Core Components of DePIN Networks

Every successful decentralized physical infrastructure project relies on four essential elements:

- Physical Infrastructure: Real-world hardware like sensors, hotspots, or storage devices

- Token Economics: Cryptocurrency rewards that incentivize participation

- Blockchain Protocol: The underlying technology that coordinates everything

- Community Network: Users who deploy, maintain, and benefit from the infrastructure

Game-Changing DePIN Examples Reshaping Industries

- Helium Network – Revolutionizing Wireless Connectivity

Remember when setting up a wireless network required calling expensive telecom companies? Helium flipped that model on its head. This **decentralized physical infrastructure** network allows anyone to deploy low-power wireless hotspots and earn HNT tokens for providing coverage.

Here’s what makes Helium fascinating: a pizza shop owner in Brooklyn can install a $400 hotspot, provide Internet of Things (IoT) connectivity to their neighborhood, and earn passive income. It’s like Uber, but for wireless networks.

Real-world impact: Helium has over 900,000 hotspots worldwide, creating the world’s largest LoRaWAN network. Companies use this network to track everything from pet collars to shipping containers.

2. Filecoin – Decentralized Data Storage Revolution

What if instead of relying on Amazon Web Services or Google Cloud, you could rent storage space from thousands of individual providers worldwide? That’s exactly what Filecoin accomplishes through its DePIN approach to data storage.

Think of it as Airbnb for hard drive space. Got extra storage on your computer? Rent it out and earn FIL tokens. Need to store important data? Access a global network of storage providers offering competitive rates and redundancy.

3. Render Network – Democratizing Computing Power

Ever watched a Pixar movie and wondered about the massive computing power behind those stunning visuals? Render Network transforms idle GPUs into a global rendering powerhouse, creating a DePIN for computational tasks.

Graphic designers and 3D artists can access high-end rendering without expensive hardware investments, while GPU owners earn RNDR tokens by contributing their processing power. It’s a win-win that’s disrupting the traditional cloud computing model.

4. WeatherXM – Community-Powered Weather Data

Weather apps rely on limited government weather stations, but WeatherXM is building the world’s largest weather network through DePIN. Community members install weather stations and earn WXM tokens for providing hyperlocal weather data.

This creates more accurate weather predictions while giving communities ownership over their local environmental data. Imagine having weather data so precise it knows the difference between your backyard and your neighbor’s!

Emerging DePIN Sectors Creating New Opportunities

- Decentralized Energy Networks

The energy sector is ripe for DePIN disruption. Projects like Power Ledger enable peer-to-peer energy trading, where your neighbor’s solar panels can power your home through blockchain-verified transactions.

Brooklyn Microgrid demonstrated this concept by allowing residents to trade solar energy directly with each other, bypassing traditional utility companies. It’s democracy applied to energy distribution.

2. Autonomous Vehicle Infrastructure

Self-driving cars need real-time data about road conditions, traffic, and hazards. DePIN projects are creating networks where vehicles contribute data and earn rewards for sharing information about their routes and conditions.

Think of it as Waze on steroids, except participants earn cryptocurrency for contributing valuable transportation data.

3. Environmental Monitoring Networks

Climate change requires unprecedented data collection. **Decentralized physical infrastructure** projects are deploying sensor networks that monitor air quality, noise pollution, and environmental conditions while rewarding participants with tokens.

PlanetWatch, for example, rewards users for operating air quality sensors, creating a global environmental monitoring network owned by the community rather than corporations.

Smart Investment Strategies in Decentralized Physical Infrastructure

- Hardware Investment Approach

The most direct way to invest in **decentralized physical infrastructure** is by purchasing and operating the hardware yourself. This approach offers several advantages:

Benefits of Hardware Investment:

- Direct token earnings from network participation

- Potential hardware appreciation as networks grow

- Physical asset ownership with tangible value

- Active participation in network governance

Popular hardware investments include:

- Helium hotspots for wireless coverage

- Filecoin storage miners for data storage

- Weather stations for environmental data

- GPU rigs for compute networks

2. Token Investment Strategy

Not everyone wants to manage physical hardware. Token investments allow you to benefit from decentralized physical infrastructure growth without operational responsibilities.

When evaluating DePIN tokens, consider these factors:

1. Network Utility: Does the token have real-world use cases?

2. Adoption Metrics: How many active participants does the network have?

3. Revenue Model: How does the network generate sustainable value?

4. Competition: What advantages does this project have over alternatives?

3. Hybrid Investment Approaches

Sophisticated investors often combine hardware ownership with token holdings, creating diversified DePIN portfolios. This approach provides multiple revenue streams while hedging against individual project risks.

Consider allocating investments across different DePIN sectors:

- 30% in established networks (Helium, Filecoin)

- 40% in emerging sectors (IoT, environmental monitoring)

- 20% in experimental projects with high upside potential

- 10% in infrastructure supporting tools and services

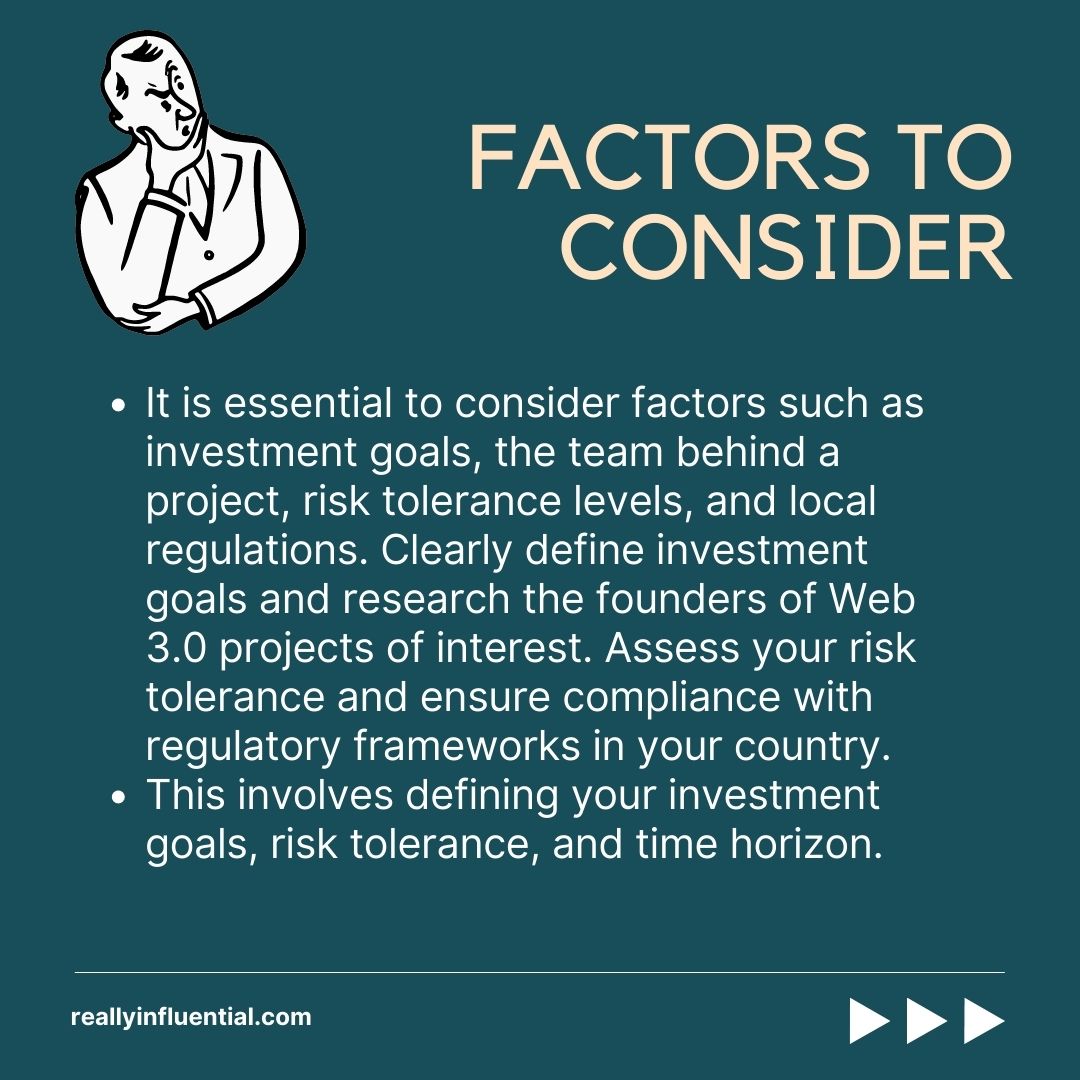

Evaluating DePIN Investment Opportunities

1. Network Effects and Growth Potential

The most successful **decentralized physical infrastructure** projects benefit from powerful network effects. As more participants join, the network becomes more valuable for everyone involved.

Look for projects with:

- Clear utility that increases with network size

- Strong tokenomics that reward early adopters

- Partnerships with enterprises that need the infrastructure

- Active developer communities building on the protocol

2. Technical Infrastructure Assessment

Not all DePIN projects are created equal. Evaluate the technical foundation by examining:

Blockchain Integration: How seamlessly does the project integrate with blockchain protocols? Is the consensus mechanism appropriate for the use case?

Hardware Requirements: Are the hardware requirements reasonable for average participants? Overly expensive equipment creates barriers to adoption.

Data Quality: How does the network ensure data accuracy and prevent cheating? Look for robust verification mechanisms.

digital services tax Canada 2025

3. Regulatory and Compliance Considerations

Decentralized physical infrastructure projects often operate in regulated industries like telecommunications, energy, and data storage. Understanding the regulatory landscape is crucial for long-term success.

Research potential regulatory risks:

- Telecommunications licensing requirements

- Data privacy and storage regulations

- Energy market regulations

- Import/export restrictions on hardware

Real-World Case Studies and Success Stories

- Helium’s Explosive Growth Story

When Helium launched in 2019, few predicted it would become one of the largest DePIN networks globally. Early adopters who deployed hotspots earned substantial returns as the network expanded.

A case study from Austin, Texas: Sarah, a software developer, installed three Helium hotspots across strategic locations in 2020. Her initial $1,200 investment generated over $800 monthly in HNT tokens during peak earning periods.

The key lesson? Early participation in high-quality DePIN networks can generate exceptional returns, but success requires strategic placement and network understanding.

2. Filecoin’s Enterprise Adoption

Filecoin’s **decentralized physical infrastructure** approach attracted major enterprises seeking alternatives to centralized cloud storage. Organizations like Internet Archive and Flow blockchain integrated Filecoin for decentralized data storage.

Storage providers who joined early benefited from increasing demand and token appreciation. The network now stores over 15 exabytes of data, demonstrating real-world utility beyond speculation.

Future Trends and Emerging Opportunities

- AI and Machine Learning Integration

The convergence of DePIN with artificial intelligence creates fascinating possibilities. Imagine DePIN networks that not only collect data but also provide distributed AI training and inference.

Projects are emerging that reward participants for contributing to AI model training while maintaining data privacy through decentralized architectures. This trend could revolutionize how we develop and deploy AI systems.

2. Integration with Smart Cities

Urban planners increasingly recognize the value of DePIN for smart city initiatives. Instead of relying on expensive centralized systems, cities can leverage community-owned sensor networks for traffic monitoring, environmental tracking, and public safety.

This creates massive opportunities for DePIN projects that can integrate with municipal infrastructure while maintaining decentralized ownership models.

3. Cross-Chain Infrastructure Protocols

The future of **decentralized physical infrastructure** isn’t limited to single blockchain networks. Emerging protocols enable DePIN networks to operate across multiple blockchains, increasing utility and reducing dependency on individual ecosystems.

Risks and Challenges in DePIN Investments

1. Technology and Hardware Risks

Physical infrastructure investments carry unique risks that purely digital assets don’t face. Hardware can break, become obsolete, or fail to generate expected returns.

Common hardware risks include:

- Equipment failure and replacement costs

- Technological obsolescence as networks upgrade

- Physical theft or damage

- Location-dependent performance variations

2. Network Adoption and Competition

The success of DePIN projects depends heavily on network adoption. Networks that fail to achieve critical mass often struggle to provide value to participants.

Evaluate adoption risks by examining:

- User growth rates and retention

- Enterprise partnerships and integrations

- Developer activity and protocol improvements

- Competitive positioning against alternatives

3. Regulatory and Market Risks

DePIN projects operate at the intersection of blockchain technology and traditional industries, creating complex regulatory environments. Changes in regulations could significantly impact project viability.

Market risks include:

- Regulatory crackdowns on cryptocurrency

- Changes in utility regulations affecting network operations

- Market volatility affecting token values

- Competitive pressure from traditional infrastructure providers

Getting Started with DePIN Investments

- Beginner-Friendly Entry Points

New investors should start with established DePIN networks that have proven track records and lower barriers to entry.

Recommended starting points:

- Purchase tokens from established networks like Helium or Filecoin

- Join mining pools to reduce individual hardware risks

- Start with lower-cost hardware options to test the waters

- Engage with community forums to learn from experienced participants

2. Building Your DePIN Portfolio

Successful DePIN investing requires diversification across sectors and risk levels. Consider this portfolio framework:

Core Holdings (60%): Established networks with proven utility

- Helium (wireless infrastructure)

- Filecoin (decentralized storage)

- Render Network (distributed computing)

Growth Investments (30%): Emerging networks with strong potential

- IoT sensor networks

- Environmental monitoring projects

- Mapping and location services

Speculative Plays (10%): Early-stage projects with breakthrough potential

- Experimental hardware networks

- Novel consensus mechanisms

- Cross-industry infrastructure bridges

FAQ: Common Questions About Decentralized Physical Infrastructure

Q: How much money do I need to start investing in DePIN projects?

A: You can start with as little as $100 by purchasing tokens, or invest $300-500 in entry-level hardware like basic IoT sensors. More advanced mining equipment typically costs $500-2000, while premium setups can exceed $5000.

Q: What’s the difference between investing in DePIN tokens versus buying hardware?

A: Token investment is passive and liquid but doesn’t provide network participation rewards. Hardware ownership generates ongoing token rewards but requires active management and carries equipment risks. Many investors combine both approaches.

Q: Are DePIN investments safe for beginners?

A: Like all cryptocurrency investments, DePIN carries risks. Beginners should start small, focus on established networks, and thoroughly research projects before investing. The physical hardware component adds both opportunity and complexity compared to traditional crypto investments.

Q: How do I evaluate whether a DePIN project is legitimate?

A: Look for projects with real-world utility, active hardware deployments, transparent tokenomics, enterprise partnerships, and engaged communities. Avoid projects that promise unrealistic returns or have vague technical specifications.

Q: Can I participate in multiple DePIN networks simultaneously?

A: Absolutely! Many investors diversify across multiple networks to spread risk and capture different opportunities. Just ensure you can adequately manage the hardware and operational requirements of each network you join.

Conclusion: The Future is Decentralized—And It’s Physical

Decentralized physical infrastructure represents one of the most exciting developments in blockchain technology because it solves real-world problems while creating genuine economic opportunities. From wireless networks that challenge telecom monopolies to storage systems that compete with Big Tech cloud services, DePIN projects are building the foundation for a more democratic digital future.

The investment opportunity is clear: early participants in successful DePIN networks often generate substantial returns while contributing to meaningful technological progress. However, like all emerging technologies, success requires education, careful evaluation, and strategic thinking.

Whether you choose to deploy hardware, invest in tokens, or pursue hybrid strategies, the key is starting with established networks and gradually expanding into emerging opportunities as you gain experience and understanding.

Key takeaways for DePIN investors:

• Focus on networks with real-world utility and growing adoption

• Diversify across different infrastructure sectors and risk levels

• Start small and scale up as you gain experience

• Stay informed about regulatory developments and technical advances

• Engage with project communities to maximize your success

The decentralized future isn’t coming—it’s already here. The question isn’t whether decentralized physical infrastructure will reshape how we think about networks, data, and infrastructure ownership. The question is whether you’ll be part of building that future or watching from the sidelines.

Are you ready to own a piece of tomorrow’s infrastructure? The opportunity is here, the technology is proven, and the networks are growing. Your journey into decentralized physical infrastructure starts with a single step—and that step could be today.